Jay-Z is no longer just synonymous with music; he’s becoming a formidable player in venture capital. MarcyPen Capital Partners, co-founded by the hip-hop mogul Jay-Z, is swiftly revolutionizing the landscape of venture investments by making strategic and cultural investments while maintaining a low profile.

Historically known as one of the greatest hustlers in hip-hop, Jay-Z, whose real name is Shawn Carter, has managed to turn his entrepreneurial skills towards finance. The creation of MarcyPen marks a significant pivot in his illustrious career, which spans music, fashion, and billion-dollar deals.

MarcyPen’s latest maneuvers can be described as nothing short of daring and strategic. Instead of relying on the customary showbiz flair, Jay-Z and his partners are opting for deliberate and calculated steps that firmly position MarcyPen among industry heavyweights. By tapping into Jay-Z’s acute business acumen and cultural foresight, the firm is proving its mettle in sectors earmarked for rapid growth.

This coming of age for MarcyPen becomes evident with its strategic investments. Notable among these is the merger of Marcy Ventures with Pendulum, founded by Robbie Robinson, a former financial advisor to Barack Obama. This merger consolidates resources and intellectual assets, embodying a classic venture model with a twist of cultural adaptability, a testament to Jay-Z’s far-sightedness.

Arguably, one of their most ambitious moves was acquiring a majority stake in GLD, a dynamic jewelry brand known for its wide appeal and aggressive growth strategy. Armed with new funding from MarcyPen, GLD is set to expand its market presence by embracing wholesale channels after having mastered the direct-to-consumer model.

MarcyPen’s influence isn’t limited to North America. Its team recently took their discussions global by meeting with Abu Dhabi’s Deputy Ruler, Sheikh Tahnoon bin Zayed. These talks centered around data protection and futuristic plans that could see a blend of culture, tourism, and entertainment landscapes. This international collaboration reflects MarcyPen’s ambitions for a global footprint that harmonizes cultural influence with technological advancements.

Post the Abu Dhabi talks, MarcyPen hasn’t stopped. Their firm led a $25 million Series B funding for Rebel, a discount recommerce company showing explosive growth across North America. This investment highlights their focus on e-commerce and market innovation.

Additionally, MarcyPen’s recent collaboration with Korea’s Hanwha Group signifies their intent to penetrate and engage with the burgeoning K-culture market. The proposed $500 million fund aimed at backing Korean culture and entertainment properties demonstrates MarcyPen’s keen eye on international culture waves.

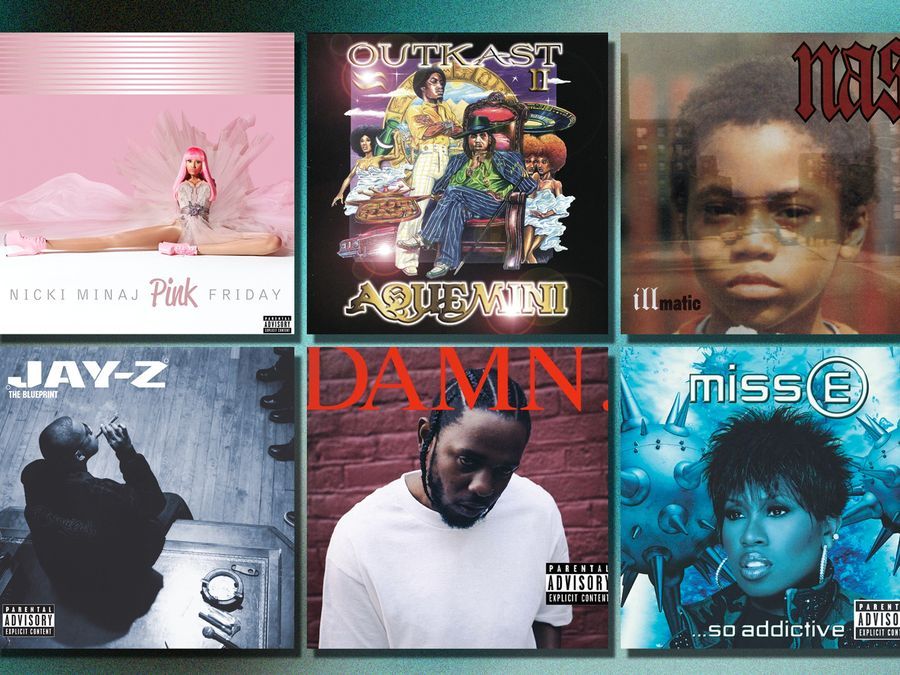

These ventures reflect Jay-Z’s transformation from a renowned lyrical genius to a shrewd investor with a cultural edge. He’s not just observing market trends, he’s creating them, and his actions are resounding within venture circuits as a blueprint for culturally resonant investments.

In essence, MarcyPen is transcending typical venture capitals by weaving culture into every deal they make. While traditional firms rely on financial metrics alone, MarcyPen looks at cultural significance and connectivity, setting a new standard for investment in our entertainment-filled world.

Jay-Z’s foray into venture capital is not just a side project, but a strategic move in shaping the future of investments. By stepping into sectors ripe with opportunities, MarcyPen not only enhances its portfolio but also affirms its growing role as a custodian of culture. As the firm continues to grow, Jay-Z’s journey from Marcy Projects to Wall Street boardrooms becomes an even more compelling narrative.